In this post, we’ll be taking a look at five different investing apps. A lot of people have been asking how to actually get started with investing in stocks or bonds or mutual funds or other types of investment vehicles. Hopefully, this post can kind of give you a layout of the opportunities that are available right now at the moment. Some of the best investing apps and stockbrokers, that you could consider starting with to start investing. Or if you have an account right now with one of these, you might want to consider switching to a different one. Depending on some of the different benefits and the pros and cons behind some of these different investment platforms.

Top 5 Best Investing Apps for Android & iOS

Please note that this list of Best Investing Apps is not necessarily in a specific order of which one is actually best, it all really depends on what type of investor you are.

So we’re going to jump into that, in this post, there should be something here for everyone. Considering that some people invest differently. Some people might want to want to do trading someday. Others might want to do some long term investing that’s what I do. Long term investing, and then there’s also active and passive investing. What type of investor are you going to be? That’s going to depend and kind of change your mind on which a stockbroker or investing theme I want to choose.

Depending on how much you’re actually investing and how often and how actively you’re doing it. Or if you just kind of passively putting into mutual funds. This will help you and decide what might be the best option for you.

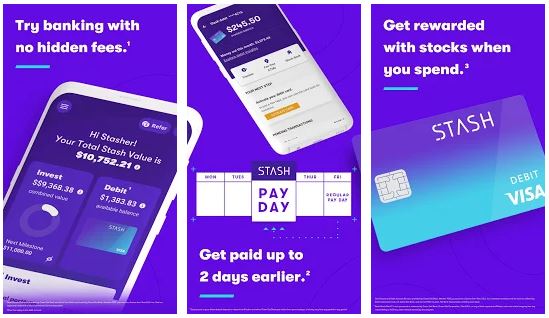

5. Stash

Let’s start with the first one here, which would be stash. Stash is really interesting because they make it very simple to start investing. You can start with as little as $5 to start investing in specific stocks. It doesn’t give you a ton of options for stocks. But it gives you the ones that you might be very familiar with already like Apple, Nike and Tesla stock. But what’s great about this is that you can buy fractional shares of the stock. So traditionally, if you want to buy one share of Amazon it’s like 17 or 1800 dollars for one share. So if you don’t have over $1,000, you can’t buy any Amazon share, but with Stash, you can do that.

With Stash, you can buy pieces of a share of stock. If you’re confused about this a little bit, just let me know down in the comments. I will try to help you out a little bit walk through this. This is one of the best features of the Stash. It also gives you opportunities to invest in ETFs and other types of funds as well as index funds. That makes it very simple and that’s what I do like about this.

They don’t charge you fees to buy and sell these stocks. These ETFs or other funds that you might be getting into. The one thing that they do have is, it starts off at $1 per month as management fees. If you have over $5,000 in the account, it gets charged at 2.5% annually off of your account. Which really isn’t too bad, that’s about the new industry standard we could say. But considering that some financial advisors, financial advisors like traditional financial advisors can charge 1% or more in some cases for their advisory Fees. 2.5%, it’s really not too bad to see that happen and I think it’s a great way to kind of just getting started with investing. You can do automatic deposits into that.

Just download the app, check it out for yourself or you can go into the website and see what they offer. So another great feature of this app is that you can set up a custodial account. Stash is for anybody even for those who are under 18. Anyone, who wants to start investing can use Stash.

You don’t know how to set up a custodial account, stash could be an option. All you have to do is bring your parents and have them help you set it up. Not every brokerage firm or investing app allows you to. For example, Robinhood as of sometime in 2019, still doesn’t allow those custodial accounts. So if you’re under 18, consider that with the Stash. They also have retirement accounts that you can set up as well, with this company. So I would suggest just head over to the website and see what they offer. No doubt, Stash is among the best investing apps.

Availability: Android & iOS

Requirements: Requires Android 5.0 and up. For iOS, it requires iOS 10.0 or later.

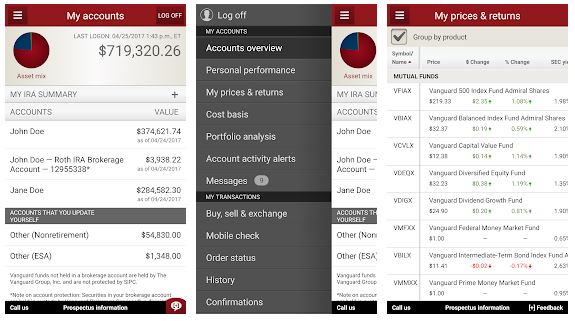

4. Vanguard

Number four on our list is Vanguard. Now you don’t think of Vanguard is an app traditionally, but it is one of the best investing apps or platforms out there. The numbers really show for it. That’s why they manage trillions of dollars worth of assets for millions of people. So, so many people use Vanguard to manage their money. And what’s great about this is that their fees are very low for long term investors. So if you’re the type of person who wants to set up an IRA or both IRA or may have a 401k through something like Vanguard.

What’s great about this is that they’re not charging you fees to operate your account. And, they’re not charging you fees to buy and sell like the mutual funds or their ETFs. You can do that for free through Vanguard and pay a really low expense ratio of 0.04% for like the S&P 500 index fund. Very low fees.

Overall, and I think it’s one of the best ways for people with long term investment. If that’s what you want to do just kind of passively throwing money into the markets. That’s what I would personally do. Keep in mind I’m not a financial advisor, these are just my personal opinions here, so you shouldn’t look into them a little bit further. But Vanguard is one of the most reputable companies in the world in the finance game.

Another great reason to consider Vanguard is that they offer so many different types of accounts. Not just the traditional brokerage account but IRA accounts as well. Many plans to have and so many different possibilities within here. That is something that you probably end up opening an account with Vanguard at some point in your life. Based on the number of opportunities that they offer for most people, Vanguard is one of the best investing apps.

Availability: Android & iOS

Requirements: Requires Android 4.3 and up. For iOS, it requires iOS 10.0 or later.

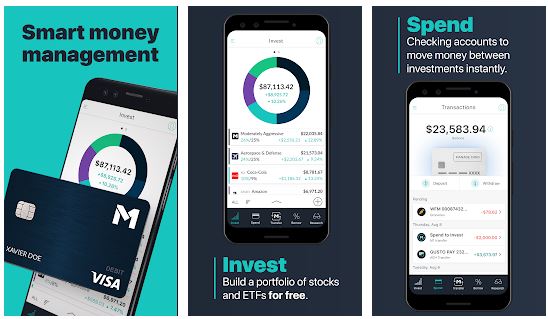

3. M1 Finance

Number three is M1 Finance, the greatest feature of this company by far is probably the fact that they offer free trading. Almost entirely free. Almost anything that you use on this platform is free. At first, I might sound a little bit outlandish, thinking how is this company free, how are they making money, isn’t a business? I need to make some money. While they do make money in a permanent interesting way. They’re making it all from the cash that’s in people’s account, they’re making interest on that. It’s kind of confusing a little bit. Some of the other strategies that they use to make money, you can read into that on their website.

One of the biggest features of M1 Finance is that you can have the kind of view like in a pie chart and you can put different investments here. So you can have to say 20% of your portfolio and technology stocks. Or 5% of your overall stock portfolio in Apple stock and then it auto rebalance. If you would like it to do that, it can auto rebalance for you. And I think it’s really focused on automating, a lot of the process like Robo advising, and that is what is interesting about it.

They are based in Chicago and they manage over 100 million dollars in assets. I believe they do seem to be a very good company very reputable company. Now they do have some other features as well, that I haven’t necessarily tried out. So, I can’t speak on them too much but they do have more spend on one borrow. So everyone spends is pretty similar to something like the Vanguard that you might see. M1 borrow is pretty interesting as well, I would be careful with that. Whenever borrowing money just kind of be wary of that a little bit. Overall, I think this company is very good for people to get started.

They don’t offer a custodial account, so if you’re under 18 at the moment they don’t offer. Overall I do like this company. I love the fact that they’re free and I think it’s great for people to get their feet wet in the market. I’m not sure if I mentioned this yet, but you can buy fractional shares and that’s one of the best aspects of it. Because if you wanted to buy Google stock a few years ago for six or $700. It was difficult to do that. But today, with fractional shares, you can put $5 into Google if you’d like. I really wish I could have done that when I first started investing. So let’s talk about the next two here. Both of them are some of my favorites.

Availability: Android & iOS

Requirements: Requires Android 5.0 and up. For iOS, it requires iOS 11.0 or later.

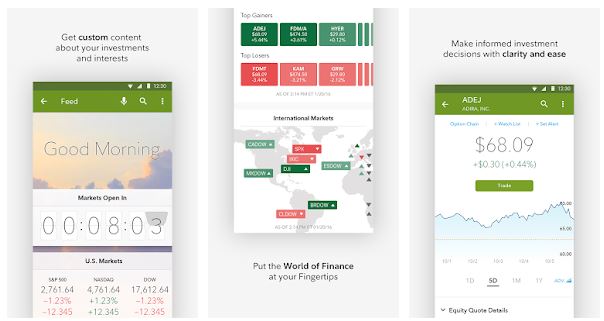

2. Fidelity

So number two is Fidelity. I would say that this is very similar to Vanguard in many features. It might not be the best choice for some people. But I think it’s a great kind of like home base, great one to put in money into mutual funds or ETFs. Because they do have very low fees and some very good reasoning. Fidelity is one of the best financial institutions in the world for investing.

This app might not be a great option for people who want to invest money into individual stocks on a consistent basis. Considering that their investment fees about $4 and 95 cents per transaction. I believe is $4 95 cents per transaction from the time you’re buying and selling stocks. So that might be a downside to that. If you’re looking for long term investing mutual funds, ETFs. Fidelity could be a good option for you.

What I like about this is that they have 24×7 customer service you can get on the line. You can call them, and get some help with some things that you need. Not everybody offers that, and I think that’s important to have especially if this is like your big nest egg. If you’re putting most of your money into something like in Fidelity. You want to make sure that you are able to pick up the phone and talk to somebody in person.

Whereas, some of these other ones don’t offer that. Another great feature is that they do offer so much for news and research. Some of these other ones like M1 Finance or stash you can’t really do a lot of research on them. With fidelity, they offer a lot of opportunities. You can even set something up or maybe you’re doing a lot of your research on something like Fidelity using their analytics. You can see what the analysts are saying, and then buying the stocks on something that has no transaction costs. That’s like a combo you could set up that could work pretty well for a lot of people.

Availability: Android & iOS

Requirements: Requires Android 6.0 and up. For iOS, it requires iOS 10.3 or later.

1. Robinhood

Now, let’s get into the last one. It’s going to be Robinhood. Robinhood has millions of users today. I remember when this first came out, somebody called me up and said, you have to do this investing platform. It’s totally free to use. And just like with that M1 Finance. I said, What the hell like this can be real? How is it free?.

How can you buy and sell stocks and investing in the markets, with no cost?. How’s the business making money?. Well, they are making money in a variety of ways. Robinhood is probably a good choice for most people getting started investing in the stock market.

Availability: Android & iOS

Requirements: For Android, it varies with the device. For iOS, it requires iOS 11.0 or later.

Final Words…

So, these are some of the best investing apps, in my opinion. As I said, I’m not a financial advisor. Don’t just trust anybody on the internet. But you can do your own research on these. These are all very reputable companies that you could consider starting with. When you consider starting investing, and not sure which one to go with. The best thing to do is considering opening up an account at a couple of different brokers or investing apps. Then see which one you like best because people have different preferences.

There are many investing apps on the Play store, which I have not included on this list. There’s a bunch of the conventional ones as well, that I haven’t really used as much as I’ve used these five. So, I couldn’t really vouch for them. If you like this post and find it useful, make sure you share it with somebody who might want to start investing or you think should start investing.

RELATED BEST APPS POSTS:

Best Volume Booster Apps for Android Phones.

Best Sports Streaming Apps for Android and iOS.

15 Best Logic Games for Android and iOS to Sharpen Your Brain.

The Best Mirror Apps for Android and iOS.

15 Best Songwriting Apps for Android and iOS.